Fine Beautiful Tips About How To Lower Credit Card Apr

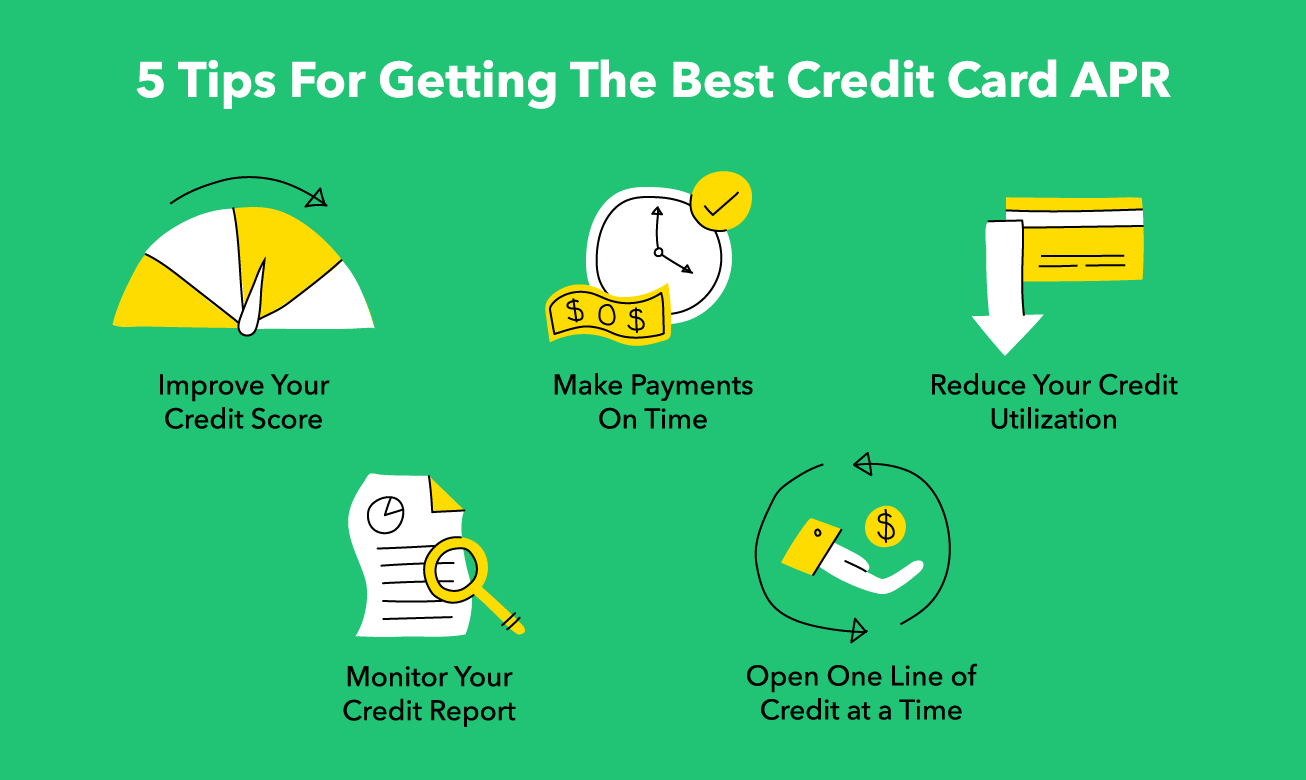

Your best path forward will depend on your monthly.

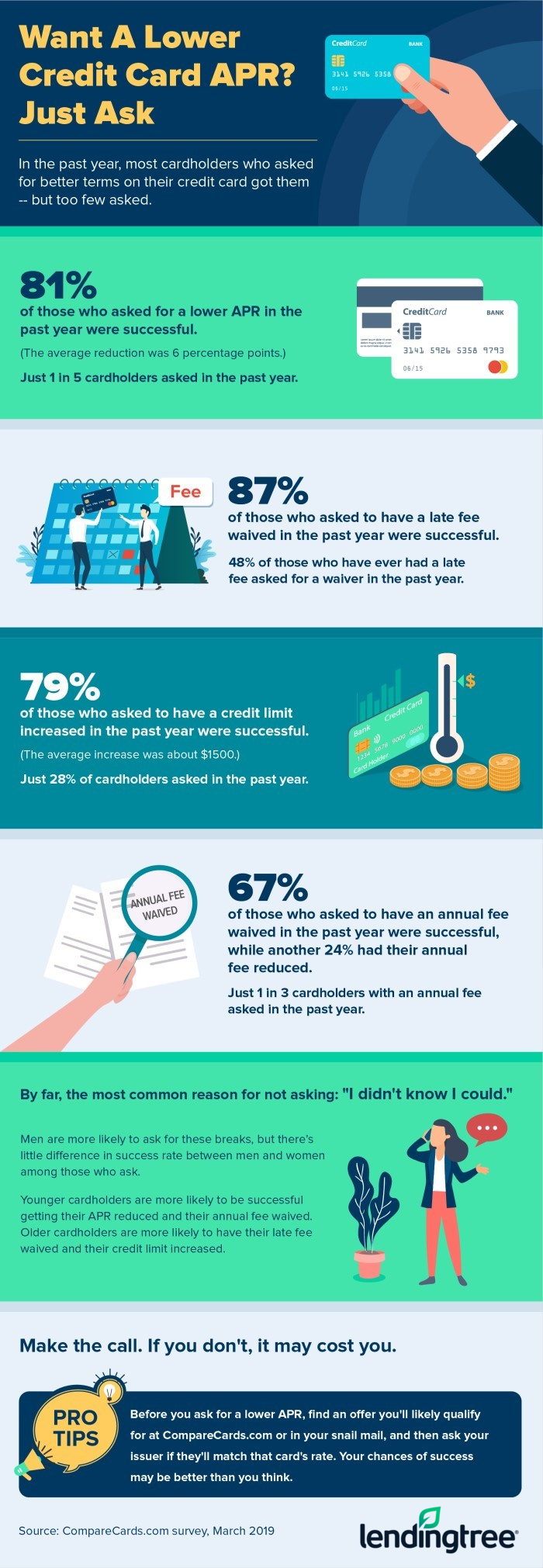

How to lower credit card apr. Here's how to negotiate with credit card companies. The squeaky wheel really does get the grease. How to lower your credit card interest rate 1.

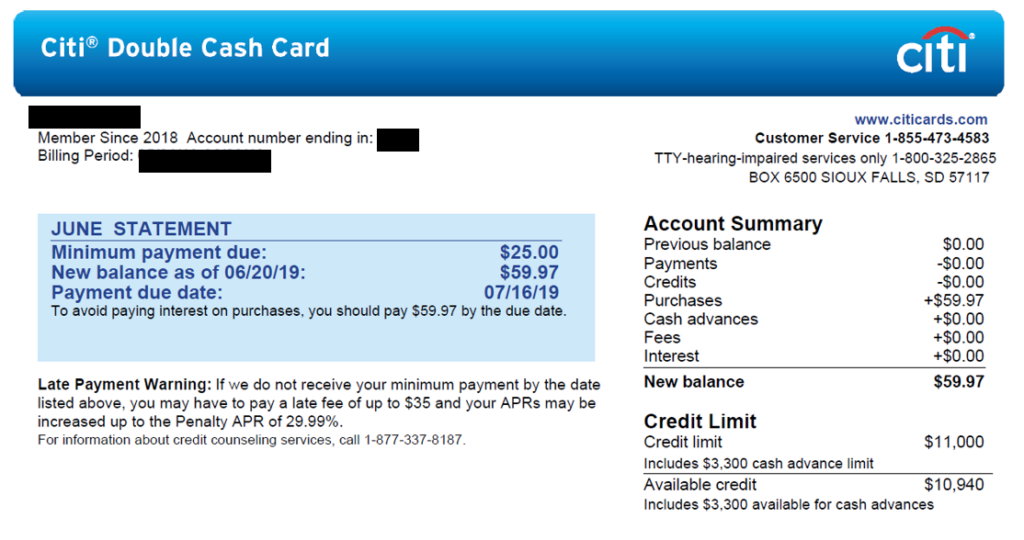

One way to pay less in interest for a limited time is to apply for a balance transfer credit card, most of which let you secure a 0 percent intro apr on transferred balances for 12. Ad get a card with 0% apr until 2024. It took me about 45 minutes to call or chat with all five of the credit card issuers:

Banks use their own internal risk assessment too. They look at payment history and length of credit. Three of the companies lowered my.

American express, chase, citi, discover and wells fargo. Ask them to transfer the call to a supervisor. However, even if you have a good fico score you need to read the fine print of your credit card agreement.

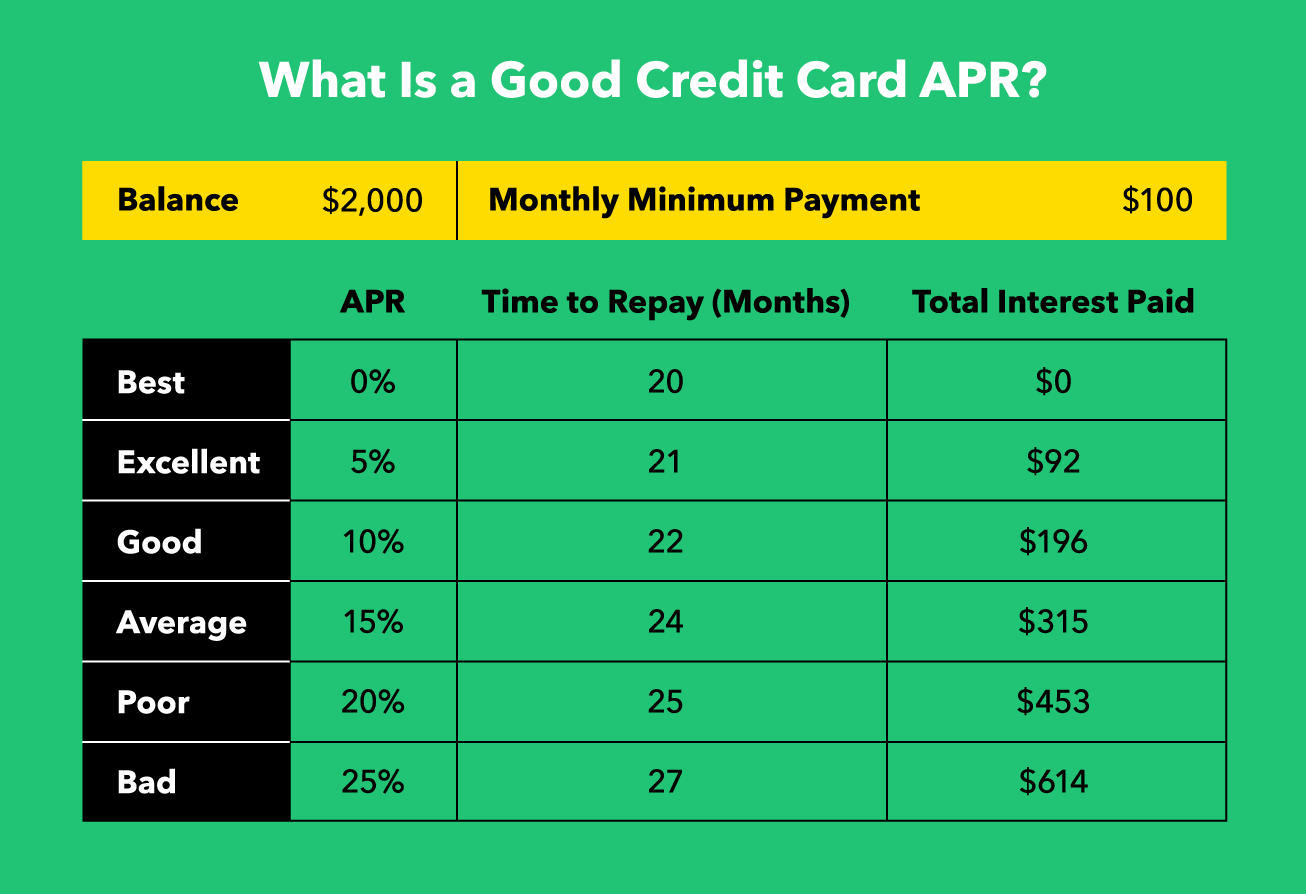

However, be prepared for the representative’s. Our experts selected the best cards to enjoy interest free payments until 2024. Rates for credit cards have already risen in response to the fed's previous rate hikes, with the average apr on a new credit card offer now at 21.59%, or more than 2.

You also avoid late fees and late payments,. How can i lower my credit card apr? Before you call the customer service number on the back of your credit card,.